Whether you’re an employee or a contractor you can use Expensify to submit your reimbursable expenses. The way you submit the expenses will depend on your country of employment and whether or not you are a contractor (these differences are outlined further down).

Expenses are normally paid monthly with payroll unless you request them earlier. You can not back date expenses more then 3 months, it is advisable to claim expenses each month. To request payment sooner please DM Head of Finance in the #company-admin Slack channel (or VP of Finance if Head of Finance is away).

To expense an item, you must have an itemised till receipt or invoice (credit card slips are unusable). Please do not take photos of receipts displayed on your computer screen, take screenshots instead.

If you have a bank detail change along with updating Bob please also inform finance either through email (billing@humanmade.com or Head of finance) or via DM to Finance on slack.

Expensify, Bob, our accounting software Xero and our banking platform are not interlinked, therefore if you can let us know we can update our records accordingly.

N.B. Guidelines on purchasing equipment can be found here.

Expensify

You can use the mobile or web application to submit your expenses.

It is advisable to take photos of receipts using the camera app on your phone instead of directly in Expensify as we’ve had problems in the past with Expensify storage.

Entering Expenses

- One report per month for personal expenses is preferable.

- Client billable expenses should be entered as a separate report with the client’s name in the report title.

- Reimbursable should always be ticked on claims paid for personally

- If the claim is to be billed to a client, billable should be ticked and the client name entered in the customer field

- The Customer field should only be completed for billable expenses, not treating the client to dinner/drinks etc.

Categories

This allows us to see how much we are spending in different categories. Again, it is important that you complete them correctly; most of them are self-explanatory but here are some clarifications for less obvious transactions:

- Subsistence costs (including coffees) go to meals – subsistence (international or national).

- Any client/WordPress community entertainment should go to entertainment 100% . This includes taking clients or community members for meals.

- Public transport receipts should go to travel-international or travel-national, taxis to travel-taxis & flight bookings to air travel.

Activity trackers

These help us to track how much we are spending on different activities in the company. Please do complete them so that we can compile accurate reports.

Tag #1 – Team

- Accounts

- Business & Finance

- Cloud

- Engineering

- Marketing

- Partnerships

- Operations

- People Operations

- Product

- Project Management

- Sales

Tag #2 – Reason

- Client – any costs associated with a client pitch, project kickoff, onsite etc

- Community – WordCamps etc

- End of Year Meal – all associated meal/travel/hotel costs

- Equipment – computer & office equipment

- General – general expenses (stationery, postage etc)

- Hiring – any cost associated with hiring (software, advertisement etc)

- Professional Development – training e.g. conferences, (and all associated travel/accommodation/subsistence costs), courses, online courses, books

- Retreat – annual retreat costs

- Remote Work Allowance – all associated remote work allowance costs (e.g. co-working spaces, internet, coffee whilst working in a cafe etc)

- Software & Tools

- Team Meetup – team meetup costs

When submitting expenses here’s how it should look:

- Input receipt data (merchant, amount, date, tax rate)

- Tick reimbursable if it’s an out of pocket expense

- Tick billable if the expense is being directly recharged to a client AND enter client name in Customers field

- Select category

- Select your team tag

- Select reason tag

Examples:

- Tom’s flight to Ops meetup:

Air travel – People Operations – Meetup - Tom’s accommodation for a client pitch:

Accommodation (international) – Sales – Client - Tom’s home internet:

Telephone & Internet – Engineering – Remote Work Allowance - Tom’s printing:

Printing & Stationery – Project Management – General - Tom’s WCUS ticket:

Conference Ticket – Marketing – WCUS - Tom’s online training course:

Staff Training – Product – Professional Development - Tom’s retreat flight:

Air Travel – Cloud – Retreat

NOTES FOR UK EMPLOYEES

- You must get a VAT or valid itemised receipt/invoice to expense a purchase. Ask for a till receipt. A credit card receipt will not do.

- If a merchant provides you with a receipt which says “this is not a VAT invoice” please ask them for one. (For purchases from a third party seller on Amazon you usually need to request it from them in the ‘Your Orders’ section of your account.)

- Train tickets must include price and journey details (departure station and destination)

- When submitting a VAT inclusive expense with a tip, gratuity or service charge, the charge should be submitted as an extra line item and allocated to VAT not reclaimable – to do this enter it as two separate expenses but using the same receipt

- If there is no VAT number on a receipt you need to set it as Not Registered for VAT

- Postage, trains, buses & bank fees should be set as Exempt Expenses under tax rate

- Air Travel should be allocated to Zero Rated Expenses

NOTES FOR AUSTRALIAN EMPLOYEES

- You must get a GST tax invoice or valid itemised receipt to expense a purchase. Ask for a till receipt. A credit card receipt will not do.

- If there is no GST it should be listed under GST Free Expenses

- Train tickets must include price and journey details (to & from)

NOTES FOR US EMPLOYEES

- You must get a valid itemised receipt/invoice to expense a purchase. Ask for a till receipt. A credit card receipt will not do.

- For subsistence or entertainment expenses an itemised receipt as well as the credit card slip is needed if a tip has been added.

- Train tickets must include price and journey details (to & from)

- Tax rate should be set to Tax On Purchases 0%

NOTES FOR CONTRACTORS

- Enter each expense into Expensify and attach a valid itemised receipt. Ask for a till receipt. A credit card receipt will not do.

- Include a line on your monthly invoice with a total figure for your expenses – ‘Expenses as entered in Expensify’.

- Submit your invoice during the last week of the month

General top tips

- Receipts must be itemised (no credit card slips)

- If you prefer, email receipts can be forwarded directly to Expensify by sending to receipts@expensify.com

- National is for anything in the country of your policy rather than the country you reside in, international for anything outside of that country e.g. if you submit expenses under the Human Made Ltd policy, any expenses in the UK go under national and anything in another country would go under international. You can see which policy you’re assigned to at the top of the page (on the desktop version) when you open Expensify.

- Coffees etc when you’re working in a cafe don’t go under co-working, that’s for co-working spaces, please put cafe drinks under meals (inter/national).

- Anything that goes into the meals category should include attendee names

- Flights are air travel not travel (inter/national)

- Only enter something in the customer field if you want one of Human Made’s clients to be invoiced!

- Reimbursable should not be ticked if entering receipts for your HM credit card (if you have one)

- If you’re using your own car for travel, instead of adding info to the Expense tab, click the next one along called Distance then enter mileage information (don’t just claim the cost of buying petrol/diesel). This cost should be taken into account when weighing up travel options (i.e. flights/trains vs. driving)

If you use SmartScan:

- Please check the details before submitting, they’re often inaccurate, especially the transaction date and currency.

- From the Settings -> Account -> Expense Rules menu you can set defaults for your expenses, for example a rule that applies to “.” to set your correct Team for all expenses.

VAT help (UK employees & contractors only)

“20% VAT” examples:

- accommodation (national)

- Airbnb service fees

- purchases/bills with a valid VAT receipt

- meals over £250 need to have a VAT number on receipt AND a VAT breakdown (if under £250 OK if receipt shows VAT number and no breakdown (unless any items are specifically marked as zero rated) but NOT other way round i.e. breakdown but no VAT number).

“Exempt VAT” examples:

- postage

- trains/buses

- insurance

- bank fees

- eye tests

“Not registered for VAT” examples:

- any EU/international purchase

- any not registered UK bills/purchases (i.e. no VAT number or breakdown on receipt)

- Airbnb (but service fee is 20%)

- most software

- Ubers/taxis

“Reverse Charge VAT” examples:

- if the receipt specifically states VAT has been reverse charged (usually some software)

“VAT not reclaimable” examples:

- if receipt shows VAT breakdown but no VAT number on receipt

- home broadband

- service/gratuity charges

“Zero Rated” examples:

- flights

- international postage (but Fedex is usually exempt, check invoice)

- cold take away food/drinks (as indicated on receipt)

- books

Automating Expensify

Email Forwarding

You can forward email receipts on to receipts@expensify.com using your registered email address, and they’ll be smart scanned into an expense. Remember to double check the results, sometimes Expensify grabs the wrong date, or price.

Expense Rules

Tired of tapping into more details and setting the same reason over and over again? If you log into the Expensify website, and go to settings, you can add automation rules.

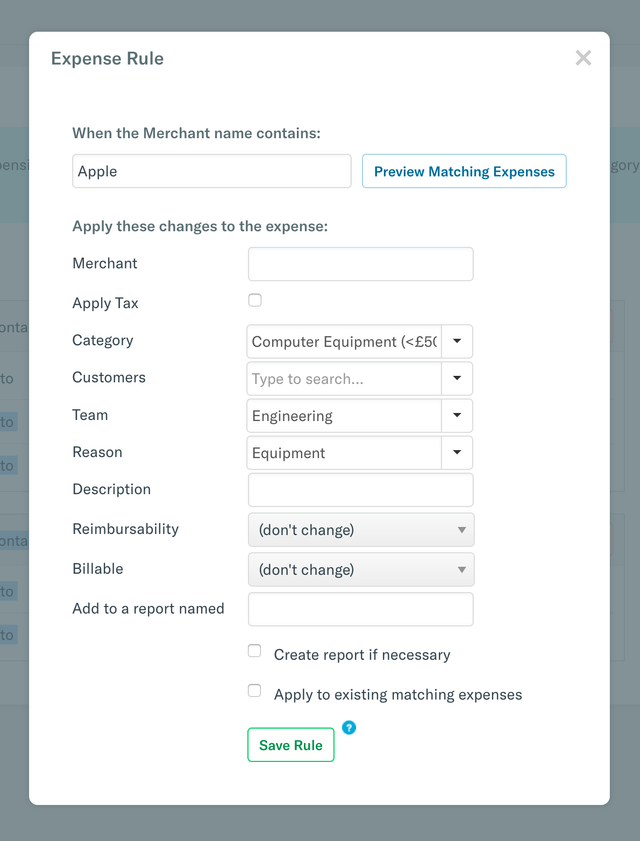

For example, this rule flags any Apple receipts as equipment:

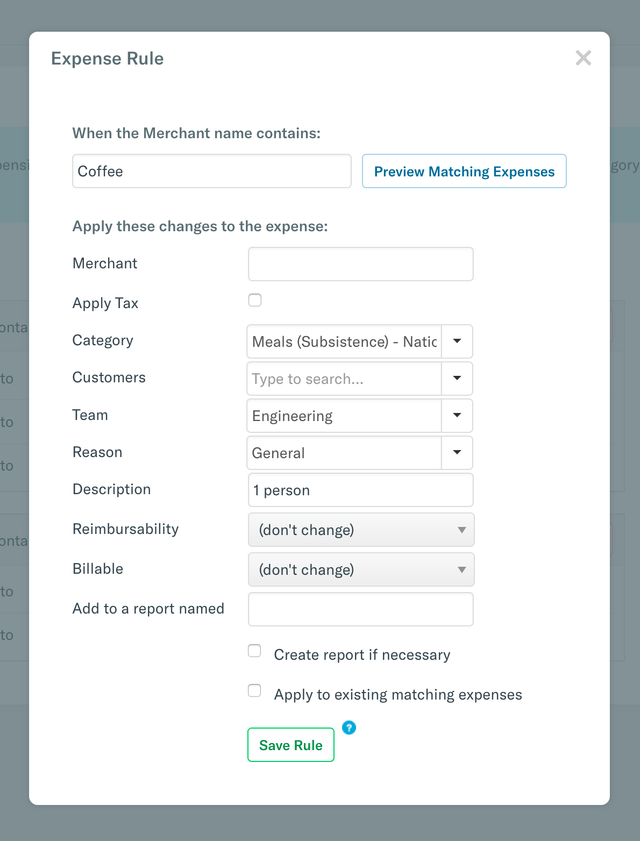

And this rule automates coffee receipts:

This is a great way to save time, for example if you meet a client in a particular venue, and need to file a receipt for that client in particular, you can automate setting the customer, and filing a client specific expense report. Or just take the manual steps out of smart scanning.